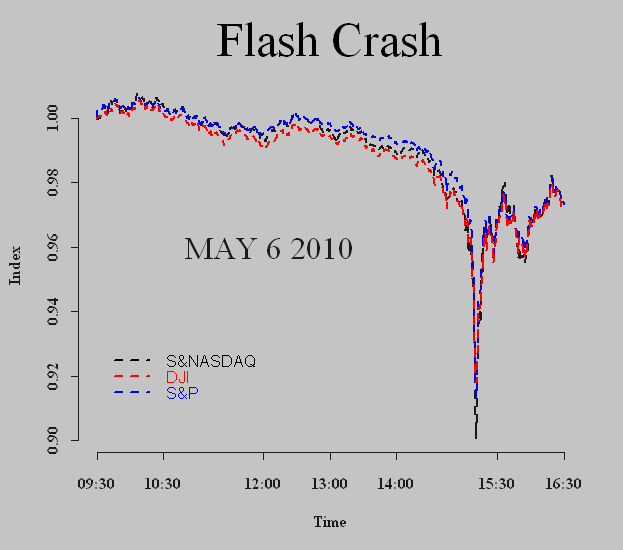

In his book, “A demon of our design”: [asa mytpl]0471227277[/asa] Richard Bookstaber talks about the concept of coupled systems. These are systems where, once launched, are impossible to shut down. One such process is a plain take off. Once started, the pilot has no way back, he cannot stop after getting off the ground, so the only way is up. Well, in financial markets, up is generally considered good, it is unfortunate that this system is coupled downwards. Take a look at the figure:

What you see is the movement of the three major indexes on May 6, 2010. I scaled the graph so that it starts at the value 1, and so the interpretation is of percentage change. What we see is that around 15:05-15:20, the INDEX fell about 7%. Economically speaking, it means 7% from the capital market value of the core companies in the U.S can be shaved off in a matter of minutes.

This event spawned some formal investigations. It was eventually dismissed as an erroneous high volume trade, which I find somewhat doubtful. Yeah, sure, some guy added couple of zeros to his market order and pressed “transmit”, and oops.. 7% drop in the S&P, imagine the embarrassment. What happened probably has a lot to do with the market structure as a whole, machines and humans both panicked and that was the result.

What ever the reason, what you should take away is that it might happen, and like many other tail events, it will seem close to impossible beforehand. Prior to this event, for a fifteen minutes time frame I am guessing (just guessing though) the maximum draw-down for an index was 7 times smaller. This is a feature of the new fast moving information technology world, a new era where the heavy “fire power” of hardware and software replaced the paper tickers one used to get as proof for owning a stock.