THIS IS NOT INVESTMENT ADVICE. ACTING BASED ON THIS POST MAY, AND IN ALL PROBABILITY WILL, CAUSE MONETARY LOSS.

Most of us are risk averse, so in our portfolio, we prefer to have stocks that will protect us to some extent from market deterioration. Simply put, when things go sour we want to own solid companies. This will reduce return fluctuation and will help our ulcer index against large downwards market swings. Large caps are such stocks. But which large caps should we chose? The squared returns are often taken as a proxy for the volatility so, keeping simplicity in mind, I use those.

I use daily data from 09/1998 till 09/2011 for 94 largest capital stock returns. I use the SPY returns as a proxy for the market return. I estimate from the regression:

I do that once only for days in which the market went up i.e. , and once only for days in which the market went down,

.

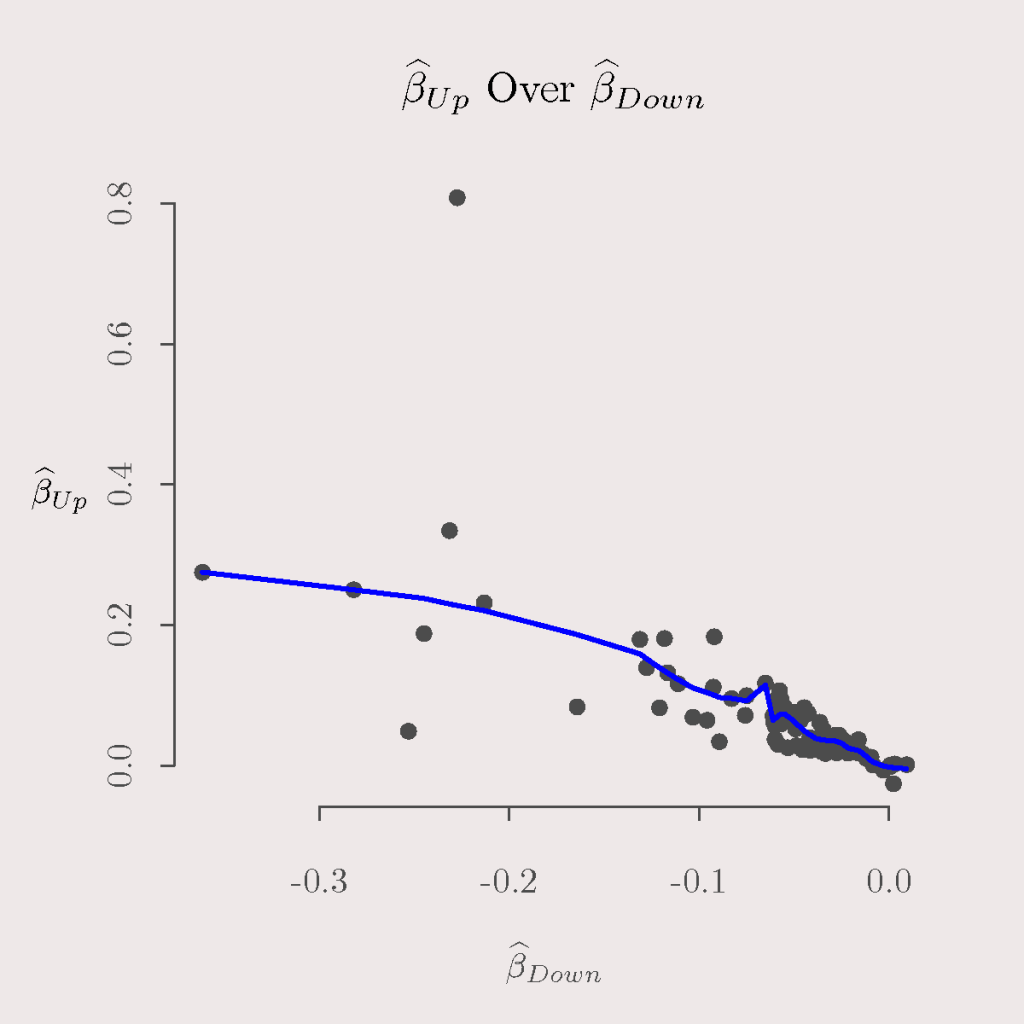

Take a look at the following graph:

I plotted

I plotted . Few things that come out from this plot:

1. These large cap behave as expected, their volatility increase when market goes up, and their volatility decrease when the market goes down.

2. Few stocks behave in a more favorable way than others. We wish to pick those companies that over the years have higher volatility on the way up, and lower volatility when market goes down.

I took the ratio vector, that is, , and calculated the names that appear to be of most value to the risk averse investor, the top 10% names are:

|

1 2 3 |

"AES" "BUD" "CPB" "ETR" "HON" "IBM" "KFT" "MRK" "MS" "NYX" |

We can see some big names like Microsoft and IBM is in there, NYSE Euronext , and few basic goods companies like Kraft Foods Inc, Campbell Soup Company. So in case you have volatility in mind, and you insist to be long these days, these are the names I would have a closer look at. That is, I would lose my money holding these symbols.

Cool post! I like the idea a lot!

Why are beta 1 negative for downside volatility? Is that because beta 0 is very positive?

beta_1 is negative for the “down” days since these are large-cap, when market goes down, these stocks do not go down that much, and so when the magnitude of the movement of the market goes up (again, in down days only..) the magnitude of the movement for these stocks go down . That does not mean the stock itself goes down or up, we do not know the direction, only that its squared return goes down when the market squared return go up.