Efficient Market Hypothesis states that the price you see is the price you should see. The price that exactly reflects the expectation of engaging a lottery. No one can predict the future, but we can all have views on possible future outcomes. Average the views of all market participants, millions of people, and not just people.. “professionals”. Now, say we look at a medicine company, and after researching properly we end up with a couple of simple future scenarios. An (FDA) approval for the company main prospective drug, say with probability 30%, or a rejection with probability of 70%. The price you see is equal 0.3*(Price if the drug is approved) + 0.7*(Price if the drug is rejected). Now, if you want, you can buy the stock and hope for the better outcome, you will get a compensation for the risk you took, but bear in mind, this compensation is fair, it’s no bargain. The price you pay will reflect both the future value if the drug is approved and the probability for this to happen. We will always get what we pay for, if the price is low it means or that there is low approval probability, or that if the drug is approved the discounted future revenue from this drug is not considerable.

Not to say you always have to agree with the market. We can have a different view from the market, we can think that the price is incorrect, too high or too low. Personally, I take great care NOT to think like that. Imagine playing chess against 1000 people, they were actively discussing which move to play, they are all good players. Thinking that you know better is the same as disagreeing with the move they decided upon. They all think the price should be “X”, none of them is willing to pay more than “X” and none of them is willing to sell for less than “X”. You are the only one who thinks “X” is incorrect. Are you THAT good? Perhaps.. I know I am not. I try, and I think everyone should try but the one common feature all the great investors share is modesty. It is possible to disagree with the market, yet having the chess example in mind, you should hold a solid battery of arguments. Understand why they want to play that move, why you do not want to play it, and why your proposed move is better. It is possible to win against them, they are not playing the best move, just their average opinion, but they are not stupid, and more importantly, they are willing to back their views with their capital (or others people capital but that’s not for this post..). My point is that you should not underestimate the crowd you are up against as so many people do. After we established the “price is right” concept, here is an efficient market hypothesis joke:

“An economist strolling down the street with a companion when they come upon a 100 dollar bill lying on the ground. As the companion reaches down to pick it up, the economist says ‘Don’t bother — if it were a real 100 dollar bill, it would not be there’.”

I especially get annoyed when I hear, “it went up too much”, or “it went down too much”, sometimes even from money managers, along with the vague “woodoo” explanation about how the market is “over-reacting”, to relate it to the previous paragraph, my opinion is that it is best to think it is me who is “under-reacting” and not the other way around.

In general, explanation or argument in favor of holding a position should revolve around why we expect the price to move in a certain direction, and it better have something to do with the economy as a whole or the individual company under scrutiny. Previous price move has nothing to do with current observed price, what you deem to be too high might be true, however it can go much higher for reasons we do not fully understand. Economists can point the direction, but they can not time the exact reversal time. For example, many hedge funds got blown out shorting the “dot.com” bubble prematurely, they understood something is wrong, and tried to resist the market, which kept on rising and rising. In the book:[asa mytpl]0471794473[/asa] one of the money manager states that: “if you are right about the direction but wrong about the timing, then you are wrong”. (Great book by the way)

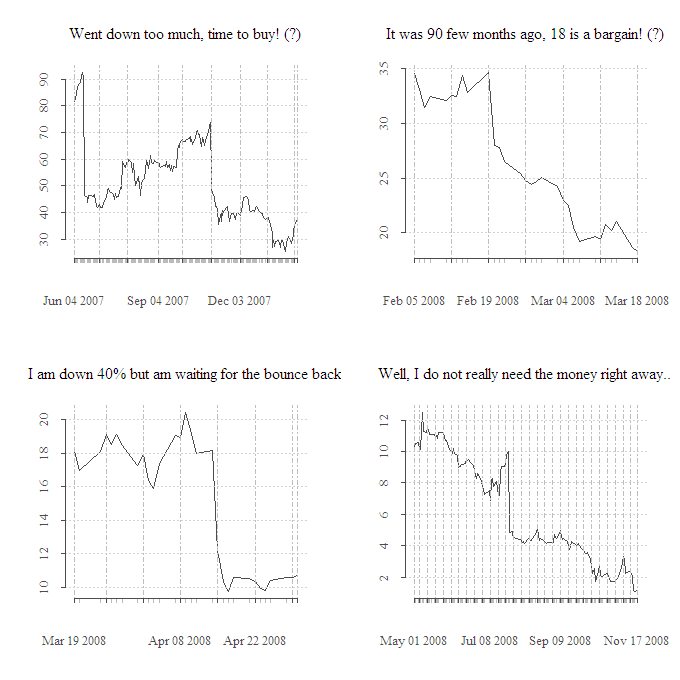

We better root out the past price movement from our system of considerations, I illustrate this point using the symbol “CROX”. I show that many times it seems as if there is too much of an increase/decrease in price, and people are tempted, solely upon the price movement, that it is time to sell or buy the stock.Once the decision is made, it is easy to “polish” it with some “it seems to be a good company” wrapper.

Have a look at the following graph. Check the “Y” axes. The bottom panel is a direct continuation of the upper panel. The stock went up about 80% in just over a year, and it seems that we can “safely” go short here, after all…how much more can it climb? 🙂

So, you can see in the bottom panel, it can go up quite a bit more, as a matter of fact, shorting it will lead to about 60% loss in about a year.

So, you can see in the bottom panel, it can go up quite a bit more, as a matter of fact, shorting it will lead to about 60% loss in about a year.

Same holds for the reverse, check the “Y” axis, you should read the graph from top left -> top right -> bottom left -> bottom right.

I have a feeling that many people were trying to catch this “falling knife”. A person who bought it for 18 and saw it decline to 1 is waiting for a 1800% increase to break even. To be honest, I thought about buying it at the price of 1, but was thinking it might go to 20 cents, today it is about 14, should I beat myself up?

So, we should exclude past price movement from out considerations system.What is an argument then? A possible argument should look something like: “I read the reports, the company just raised enough capital to build a new factory…” , “The company plans to enter the European market where it expects to see high revenues, these expectation are based on surveys from..” coupled with, “these factors are not prices in yet because..” Not easy I agree, but then again what is. There can be many reasons for holding a position, but I assure you, it is never a good thing to decide a price should reverse since it went up/down “too much”.