I just finished reading an interesting paper by Justin Birru titled: “Day of the week and the cross-section of returns” (reference below). The story is much too simple to be true, but it looks to be so. In fact, I would probably altogether skip it without the highly ranked Journal of Financial Economics stamp of approval. However, by the end of the paper I was as convinced as one can be without actually running the analysis.

The story goes as follows: people tend to evaluate future prospects optimistically when they have good mood (go on..). People like weekends (ok). People have better mood on Friday before heading for the weekend, than on Monday when they need to wait five more days (hard to disagree). So, some stocks should exhibit a day-of-the-week variation whereby returns are higher on Fridays than they are on Mondays, which is what the paper forcefully shows. Some stocks, but which? those that are harder to evaluate. Citing from the paper:

… stocks that are hard or highly subjective to value properly and/or stocks that have the greatest impediments to arbitrage. Stocks that are difficult to arbitrage or difficult or subjective to value tend to be stocks that are small, young, volatile, unprofitable, non-dividend paying, lottery-like, prone to speculative demand, potentially close to distress, or extreme growth.

Using long-short strategies, the paper shows that one can actually predict the cross section of returns.

A full blown replication is out of my depth. But it was easy to query for correctness one of the statements. Precisely, again citing directly from the paper:

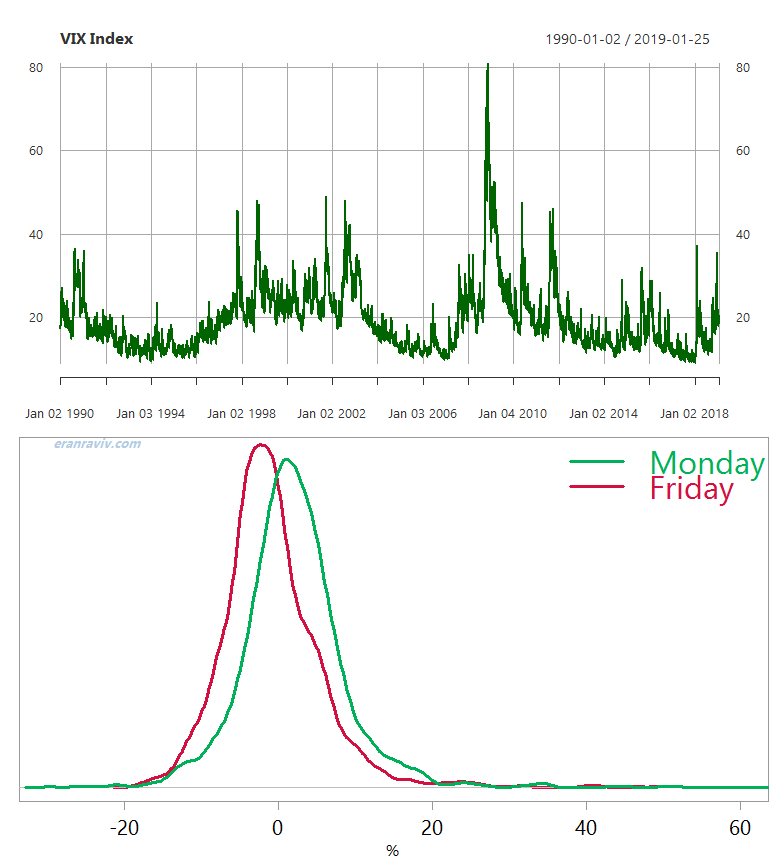

I find, consistent with decreasing sentiment on Monday, a strong and robust 2.16% average daily increase in VIX on Mondays. On Fridays, VIX experiences an average daily decrease of nearly 70 basis points.

This statement can be checked with very few lines of code.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

library(quantmod) ; citation("quantmod") # Get quotes of the VIX index from yahoo symetf = c("^VIX") end <- format(Sys.Date(),"%Y-%m-%d") start <- "1990-01-01" dat <- getSymbols(symetf, src="yahoo", from=start, to=end, auto.assign = F,warnings = FALSE,symbol.lookup = F) # Find Mondays and Fridays ind_monday <- weekdays(index(dat[,1])) == "Monday" ind_friday <- weekdays(index(dat[,1])) == "Friday" # use closing prices and make numeric vix_close <- dat[,"VIX.Close"] %>% as.numeric # Calculate percent move for those days vix_cc_friday_move <- 100*(vix_close[which(ind_friday)] / vix_close[ which(ind_friday) - 1] - 1 ) vix_cc_monday_move <- 100*(vix_close[which(ind_monday)] / vix_close[ which(ind_monday) - 1] - 1 ) # get summary summary(vix_cc_friday_move) Min. 1st Qu. Median Mean 3rd Qu. Max. -18.2220 -4.5264 -1.4687 -0.7114 2.2663 51.7192 summary(vix_cc_monday_move) Min. 1st Qu. Median Mean 3rd Qu. Max. -29.573 -1.640 1.735 2.159 5.233 115.598 |

As you can see the means line up to the first decimal point as stated in the paper. Densities are also quite different:

The notion that the day of the week can be effectively used as an explanatory variable in any kind of predictive model for stock returns sounds SO nonsensical. Given the genuinely striking results, perhaps the paper will ignite a more profound research efforts in that unexpected direction.

References

J Birru – Journal of Financial Economics, 2018 – Elsevier

link to working paper version do

Hi Eran,

Is it possible if we consider there are predetermined days in a week that are chosen for futures/options expiry (which lead to hedging activities) or ETF rebalancing days?

I don’t have yet a hypothesis to validate on this, but looking from this perspective, the phenomenon is not so nonsensical anymore.

Would love to hear your thoughts!

Tho

Thanks for this article. Here is my article response. http://www.priceactionlab.com/Blog/2019/04/fat-tails-vix/